Growth usually depends on access to resources, funding, and market opportunities in the lively business world. These can be difficult for small and medium-sized businesses (SMEs) to find. This is where registering as a small, micro, and medium enterprise (MSME) is important. Numerous advantages offered by MSME registration enable companies to grow, compete, and prosper in their particular markets. How MSME Registration Can Help Your Business Grow. Here’s a thorough examination of how MSME registration might support the expansion of your company.

Unlock Government Benefits and Subsidies

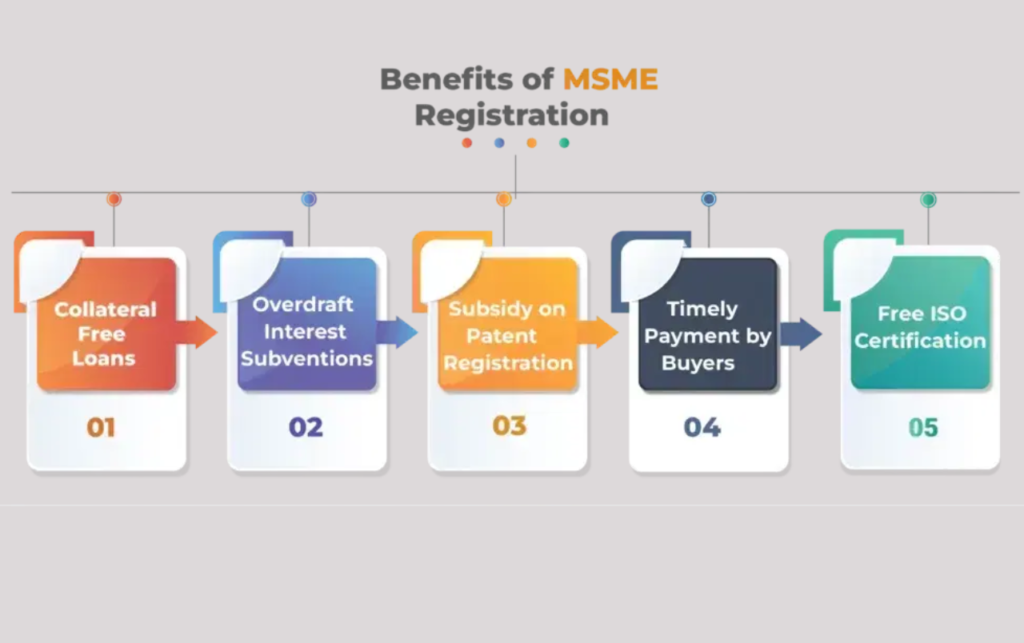

Access to various government programs and incentives is one of the main benefits of MSME registration. These consist of:

Subsidized Loans: Loans with lower interest rates are available to registered MSMEs, which facilitates investment in expansion plans.

Capital Subsidies: A few government programs offer financial aid for the acquisition of equipment or the adoption of new technologies.

Reimbursement Plans: MSMEs are frequently eligible for reimbursements for costs such as submitting patents or getting ISO certifications. How MSME Registration Can Help Your Business Grow.

These grants lower operating expenses and release funds for growth and innovation.

Easier Access to Credit

The legitimacy of a company in the eyes of financial institutions is greatly increased by MSME registration. For registered MSMEs, banks and NBFCs provide a range of special financing programs, such as:

loans from the Credit Guarantee Fund Trust for Micro and Small Businesses (CGTMSE) that don’t require collateral.

lower interest rate overdraft facilities.

This availability of reasonably priced loans aids companies in managing cash flow, scaling operations, and financing new initiatives.

Tax Benefits and Exemptions

Small businesses may find taxes to be a significant burden. Nonetheless, relief from MSME registration comes in the form of

Direct Tax Exemptions: MSMEs are able to claim tax deductions on their profits under several schemes.

Reduced GST Rates: A lot of MSMEs are able to offer their goods and services at reduced GST rates.

Capital Gains Exemptions: Under certain plans, profits from the sale of assets may be reinvested in the company tax-free.

Profitability is raised, and more money is available for investments because to these exemptions.

Protection Against Delayed Payments

Failures in buyer payments can cause cash flow problems that might bankrupt small firms. Legal protection from such delays is provided by the MSME Development Act by:

requiring payment from customers within 45 days of delivery of goods or services.

granting MSMEs the right to compound interest if payments are delayed.

This guarantees steady cash flow, allowing companies to function without financial strain.

Eligibility for Government Tenders

Businesses can profit greatly from government tenders, but they frequently have strict eligibility requirements. This is made easier by MSME registration by:

allowing MSMEs that are registered to avoid paying Earnest Money Deposits (EMDs).

granting MSMEs access to special bids.

This gives small firms a fair playing field so they can compete for big contracts and get a lot of publicity.

.

Reduced Costs for Intellectual Property Rights (IPR)

Protecting intellectual property is crucial for business growth, but it can be expensive. MSME registration makes it affordable by offering:

- Subsidized fees for filing patents, trademarks, and copyrights.

- Financial assistance for IPR awareness and registration campaigns.

This encourages innovation and ensures businesses can safeguard their unique ideas and products.

7. Market Expansion and Export Promotion

Expanding into new markets, especially international ones, can be challenging. MSME registration helps by:

- Offering export subsidies and incentives.

- Reducing the cost of export certifications.

- Providing access to trade fairs and international exhibitions.

These benefits help MSMEs tap into global markets and increase their revenue streams.

8. Enhanced Business Credibility

MSME registration acts as a badge of credibility for businesses. It signals to clients, partners, and financial institutions that the enterprise is legitimate and compliant with regulations. This trust translates into:

- Better relationships with suppliers and customers.

- Easier collaboration with larger corporations.

- Improved chances of securing partnerships and investments.

9. Technology and Skill Development Support

The government encourages MSMEs to adopt modern technology and upskill their workforce by offering:

- Subsidies for purchasing advanced machinery or software.

- Free or discounted training programs for employees.

This not only enhances productivity but also positions the business to compete more effectively in the market.

10. Support During Economic Downturns

During economic slowdowns or crises, MSMEs often face challenges like reduced demand and liquidity issues. Registered MSMEs receive priority support in such times through:

- Emergency credit schemes.

- Deferment of loan repayments.

- Financial packages announced by the government to support small businesses.

These measures ensure that businesses can weather economic storms and continue their growth trajectory.

Conclusion

MSME registration is not just a formality; it’s a strategic move that opens the door to a plethora of benefits. From financial assistance and tax exemptions to market opportunities and legal protections, the advantages are designed to empower businesses at every stage of their journey.

For small and medium enterprises aiming to scale, innovate, and thrive, MSME registration is an essential step. If you haven’t registered your business yet, now is the time to leverage the growth opportunities it offers. Start your MSME registration today and unlock the potential for a brighter and more prosperous future.