Although the indirect tax system in India has been made simpler by the Goods and Services Tax (GST), small business owners must be aware of the GST turnover restrictions. Understanding when GST registration is required can help you avoid fines and compliance issues, whether you are managing a small business, a manufacturing facility, or an online site.

The GST turnover limit for small enterprises in India will be covered in this blog, along with information on who must register, exemptions, special initiatives, and useful frequently asked questions.

What is the Turnover Limit and What Is GST?

A number of indirect taxes, including service tax, VAT, and excise duty, were superseded by the Goods and Services Tax (GST), a single tax. It pertains to the distribution of products and services throughout India.

The turnover cap for small firms establishes:

Is it necessary to register for GST?

Which GST scheme type—composition or regular—applies?

How tax payments and compliance are computed.

You may be excused from GST registration if your company’s turnover is less than the allowed amount, which lowers the cost of compliance.

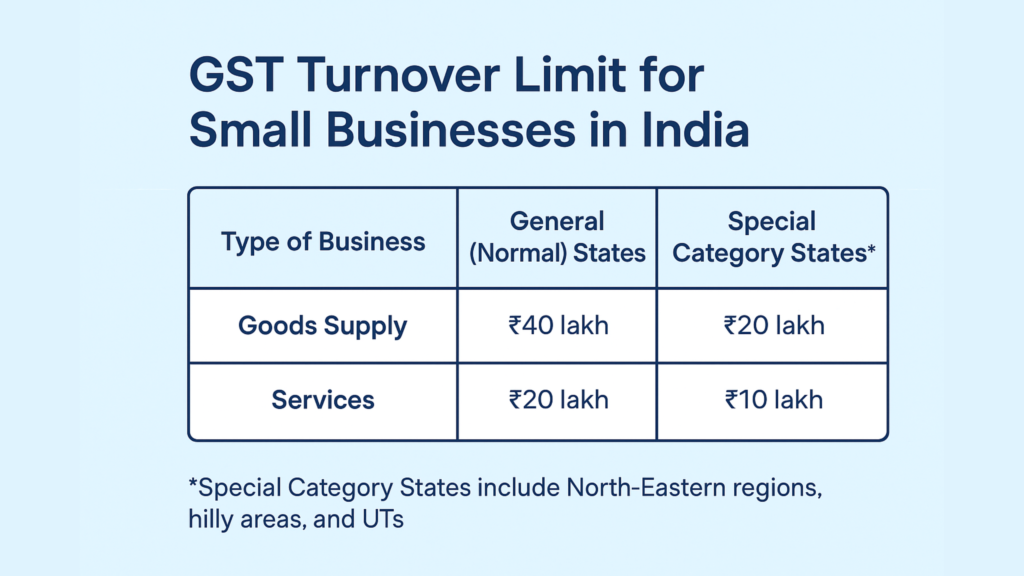

Indian Small Business GST Turnover Limits (FY 2025)

The location and type of business you run determine the GST turnover limit.

A. For items with an annual turnover of ₹40 lakh, most states require suppliers to register for GST.

The yearly turnover cap for special category states is ₹20 lakh.

(Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, and Uttarakhand are among the states that fall under the special category.)

B. For services with a yearly revenue of ₹20 lakh, most states require service providers to register for GST.

The yearly turnover cap for service providers in states that fall under special categories is ₹10 lakh.

C. Scheme of Composition

The GST Composition Scheme is an option for small enterprises looking to lower their tax liability and compliance:

How to Calculate GST Turnover

YOur GST revenue consists of:

The taxable supply value.

Exempt supply value.

products and/or services that are exported.

supplies from other states.

It excludes the actual GST amount as well as inward supplies that are subject to reverse charge tax.

4. Example of GST Turnover Limit Application

- GST registration is not required if you own a retail establishment in Delhi that sells goods valued at ₹38 lakh during a fiscal year.

- You have 30 days to register for GST if your turnover exceeds ₹40 lakh in a single year.

- Since the service ceiling in special category states is ₹10 lakh, you must register for GST if you are an Assamese service provider with an annual turnover of ₹11 lakh.

5. Benefits of GST Registration for Small Businesses

Even if your turnover is below the threshold, voluntary GST registration can be beneficial:

- Input Tax Credit (ITC) – Claim GST paid on purchases.

- Business Credibility – Attract bigger clients who prefer GST-registered vendors.

- Interstate Sales – Sell goods/services across states without restrictions.

- E-commerce Sales – Sell on Amazon, Flipkart, and other platforms.

6. GST Compliance for Small Businesses

If you register for GST:

- You must issue GST-compliant invoices.

- File GST returns monthly/quarterly.

- Maintain proper records of sales, purchases, and tax payments.

- Pay applicable GST before due dates.

7. Penalties for Not Registering Under GST

Failing to register when your turnover crosses the limit can lead to:

- Penalty of 10% of tax due (minimum ₹10,000).

- 100% penalty in cases of deliberate tax evasion.

8. GST Composition Scheme for Small Businesses

The GST composition scheme allows eligible businesses to pay tax at a lower rate and file simplified returns.

Tax Rates under Composition Scheme:

- Manufacturers and traders of goods – 1%

- Restaurants (not serving alcohol) – 5%

- Service providers – 6%

Advantages:

- Lower tax rate.

- Quarterly return filing.

- Reduced compliance burden.

Disadvantages:

- Cannot claim Input Tax Credit.

- Cannot make interstate sales (except for service providers under the 6% rate).

- Cannot deal with e-commerce platforms (except service providers under new provisions).

9. Recent Changes in GST Turnover Limit

To make it easier for small enterprises to comply, the GST Council periodically updates the turnover restrictions. The barrier for items was raised from ₹20 lakh to ₹40 lakh in recent years, which helped micro and small businesses.

10. How Small Businesses Can Stay GST Compliant

- Track turnover regularly to avoid missing the registration deadline.

- Maintain digital records for easy GST return filing.

- Use GST accounting software to automate invoicing and compliance.

- Consult GST experts for tax planning and compliance.

FAQs – GST Turnover Limit for Small Businesses in India

Q1: What is the GST turnover limit for goods in India?

For most states, ₹40 lakh annually. For special category states, ₹20 lakh.

Q2: What is the GST turnover limit for services?

For most states, ₹20 lakh annually. For special category states, ₹10 lakh.

Q3: Is GST registration mandatory for interstate sales?

Yes, for goods suppliers. However, service providers making interstate supplies are exempt until they cross the turnover limit.

Q4: What happens if I cross the GST limit mid-year?

You must apply for GST registration within 30 days of crossing the limit.

Q5: Can I register for GST voluntarily?

Yes, you can register voluntarily to avail Input Tax Credit and increase business credibility.

Q6: What is the turnover limit for GST composition scheme?

₹1.5 crore for goods (₹75 lakh for special category states) and ₹50 lakh for services.

Q7: Do e-commerce sellers need GST registration?

Yes, GST registration is mandatory for selling through e-commerce platforms, regardless of turnover (except for service providers under certain conditions).

Final Thoughts

Understanding the GST turnover limit is essential for Indian small businesses in order to prevent fines and make sound financial plans. Compliance guarantees seamless operations and business expansion, regardless of whether you are subject to the composition scheme or the standard GST system.

It’s advisable to speak with a GST specialist to determine the optimum tax plan for your company if your turnover is getting close to the cap.