The process of starting a business may be both rewarding and difficult, and the success of the venture depends on the choice of corporate structure. How to Register a One-Person Company (OPC) in India: A Step-by-Step Guide A One-Person Company (OPC) is a common choice for solitary entrepreneurs and small business owners in India. This arrangement permits an individual to function autonomously while providing the advantages of restricted liability and a distinct legal entity.

What is a One-Person Company (OPC)?

This article will discuss the advantages of this business structure, important factors to keep in mind, and the detailed procedure for forming a one-person company in India.

Benefits of Registering an OPC

- Protection against Limited Liability

- Business debts and liabilities are protected from the owner’s personal assets.

- A distinct legal entity

- An OPC is separate from its owner and has its own legal existence.

- Management Simplicity

- Decision-making is simple and quick because there is only one owner.

- Continuity of Business

- In the event of the owner’s death or incapacitation, a nominee director guarantees the company’s survival.

- Compliance Ease

- Comparatively speaking, OPCs are subject to fewer compliance obligations than private limited businesses.

- Make sure you fulfil the following requirements before forming a one-person company:

- The owner must reside in India and be a natural person.

- The owner and director may only be one person.

The nominee director, who will assume control of the business in the event of the owner’s death or incapacity, must be chosen by the owner.

There should be no more than ₹50 lakhs in paid-up capital and no more than ₹2 crores in business turnover. If not, the OPC will have to become a private limited corporation.

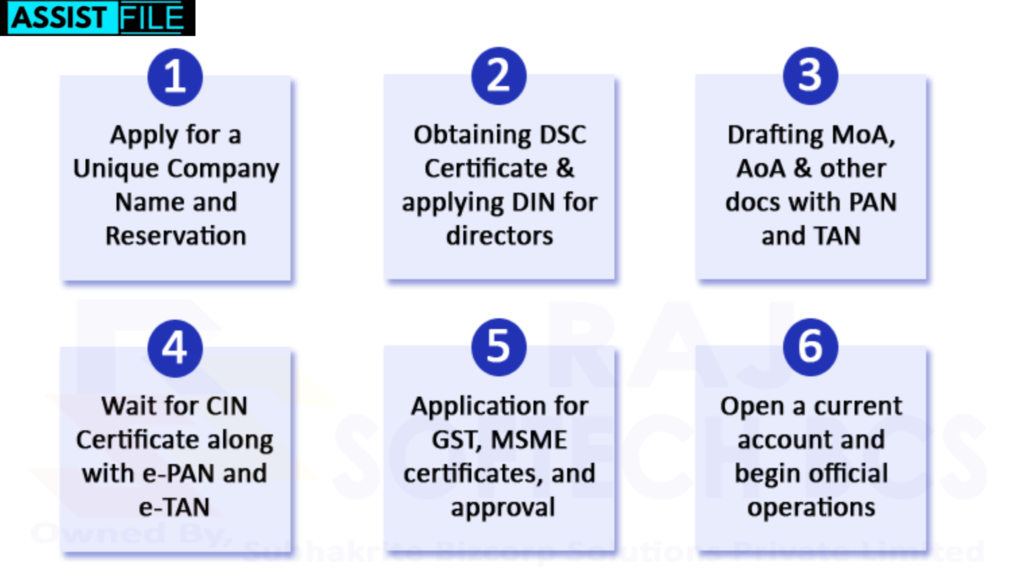

Step-by-Step Process to Register an OPC

Obtain a Certificate of Digital Signature (DSC).

Obtaining a Digital Signature Certificate (DSC) is the first step in registering an OPC. In order to sign electronic documents during the registration procedure, this is necessary.

To submit an application for a DSC, go to a certified authority.

Send in the relevant paperwork, including a passport-sized photo and proof of identification and address.

Get a Director Identification Number (DIN) by applying.

A Director Identification Number (DIN) is required for each director of a firm. The lone director must apply for a DIN in order to be an OPC.

Open the Ministry of Corporate Affairs (MCA) portal and log in.

Send in Form DIR-3 with evidence of address and identity.

Select a Distinct Name for Your Business

Choosing a distinctive name for your OPC is essential if you want to prevent rejection during the approval procedure.

Make sure that the name conforms with the MCA’s naming standards.

Check the MCA portal for name availability.

Use the SPICe+ Part A form to reserve the name.

Create the Articles of Association (AOA) and Memorandum of Association (MOA).

While the AOA lays forth the internal rules and regulations, the MOA describes the company’s goals.

Add the name of the nominee director to the MOA.

Make sure every aspect is correct and in line with the goals of the business.

Save the SPICe+ document.

A thorough form for company registration is the SPICe+ (Simplified Proforma for Incorporating Company Electronically Plus) form.

Enter the firm name, address, and director data in the SPICe+ form after logging into the MCA site.

Include the necessary documentation, such as:

Evidence of the nominee’s and director’s identities and addresses.

Director’s DIN and DSC.

Utility bills and leasing agreements are examples of documentation proving the registered office address.

Cover the registration costs.

The permitted capital of the business determines the registration fees. Use the MCA portal to make the payment, and save the receipt for your records.

Incorporation Certificate

A Certificate of Incorporation is issued by the Registrar of Companies (ROC) following the application’s approval and verification. This document contains the company’s Corporate Identity Number (CIN) and attests to the creation of your OPC.

Documents Required for OPC Registration

- Identity Proof

- Aadhaar card, PAN card, or passport of the director and nominee.

- Address Proof

- Voter ID, driving license, or utility bill (not older than two months).

- Proof of Registered Office

- Utility bill, rental agreement, or property ownership deed.

- Photographs

- Passport-sized photographs of the director and nominee.

- Nominee Consent

- Form INC-3, signed by the nominee, consenting to act as the nominee director.

When an OPC Should Be Converted to a Private Limited Company

- A private limited company must be formed from an OPC if

- It makes more than ₹2 crores a year.

- It has more than ₹50 lakhs in paid-up capital.

- The conversion procedure entails completing the required paperwork and adhering to the Companies Act’s compliance standards.

Why Choose Assistfile for OPC Registration?

At Assistfile, we simplify the OPC registration process, ensuring a hassle-free experience for entrepreneurs. Here’s why you should choose us:

- Expert Guidance: Our team of experts ensures error-free documentation and filing.

- Timely Updates: Stay informed at every step of the registration process.

- Affordable Pricing: Competitive rates with no hidden charges.

- End-to-End Support: From acquiring DSC to obtaining the Certificate of Incorporation, we’ve got you covered.

Conclusion

For lone entrepreneurs wishing to create a formal company structure with limited liability, registering a One-Person Company (OPC) is a great option. You may guarantee a successful and seamless registration process by adhering to the detailed instructions provided in this blog.

While you concentrate on expanding your company, let Assistfile take care of the details. To begin the process of OPC registration, get in touch with us right now!