Partnership Firm Registration Online

A partnership firm is one of the most popular forms of a business organization in India where two or more people come together with a common object to set up a business and divide the profits under an agreed ratio. To form a partnership, to or more people are required to come together and agree to share profits as well as losses in the equal ratio or predetermined ratio and also A Partnership Deed between two partners or more than two partners can be formed and A Partnership Firm or Partnership Deed Registration through a contract. All types of partnership firms are governed under the Indian act of 1932.

Our Inclusive Services

- Drafting of Partnership Deed

- Name Search & Approval

- PAN Registration

- TAN Registration

- MSME Certificate (Optional)

- GST Registration Certificate

- First 2 Months GST Return Free

Documents Required For Partnership Firm Registration

- Passport size photograph of all Partner

- Firm/Company Address.

- Personal all Partner Pan Card Copy

- Email-id and Contact Number

- Name of Top 5 Products / Services in which the company is dealing

- Savings bank account statement or canceled check (one Partner)

- A copy of the electricity bill/rent agreement

- All Partner Aadhar card/voter id/Passport Soft copy

- All Partner percentage

Steps of Partnership Firm Registration

After the payment received from you, our company will take the following step.

- Choose a Partnership Firm Name.

- Document preparation and Create a Partnership Deed.

- A partner can Consider whether additional clauses are needed.

- Registration of a partnership firm

- Sending your application for a sign to all the partners.

- Applying for PAN and TAN.

- Applying for GST Registration

- Sending you a partnership kit.

Benefits of Partnership Firm

- A Partnership Firm is Easy to establish and can start at a low cost.

- In a Partnership Firm, decision making could be faster because there is no concept of passing of resolutions.

- A Partnership Firm raises funds easily compared to a proprietorship firm.

- A Partnership Firm has the availability of large resources.

- A Partnership Firm is a flexible organization, as suitable changes can be easily introduced whenever necessary.

- In a Partnership Firm, each partner has an unlimited Liability in the firm

- An opening of the Current Bank Account on the basis of PAN Card and Registered Partnership Deed.

Partnership Firm Registration Consultants | LLP Registration Consultants in Delhi | Pvt. Ltd. Company Registration Consultants in Delhi | Proprietorship Firm Registration in Delhi

Advantages of Partnership Firm Registration

The following are the benefits of Partnership Firm Registration in India:

1:Easy to Incorporate: In comparison to other types of business organization’s, forming a partnership firm is simple. By preparing the partnership deed and entering into the partnership agreement, the partnership firm can be formed. Other than the partnership agreement, no other documents are necessary. It is not even required to be registered with the Registrar of Firms. A partnership firm can be created and registered at a later date because registration is optional.

2:Less Compliance: In comparison to a corporation or an LLP, a partnership firm is subject to far fewer regulations. The partners do not require a Digital Signature Certificate (DSC) or a Director Identification Number (DIN), which are required for LLP company directors or designated partners. Any changes to the business can be readily implemented by the partners. Their operations are subject to legal constraints. It is less expensive to establish than a corporation or limited liability partnership. The dissolution of a partnership firm is simple and requires few legal requirements.

3:Quick Decision: Because there is no distinction between ownership and management in a partnership firm, decision-making is swift. All choices are made collaboratively by the partners and can be applied instantly. The partners have broad powers and actions that they can carry out on behalf of the company. They can even conduct transactions on behalf of the partnership firm without the agreement of the other partners.

4:Sharing of Profits and Losses: The partners split the firm’s profits and losses evenly. They can even choose their own profit and loss ratio in the partnership firm. They feel a sense of ownership and accountability because the firm’s profitability and turnover are based on their efforts. Any loss incurred by the firm will be shared equally or in accordance with the partnership deed ratio, alleviating the weight of loss on one individual or partner. They are jointly and severally accountable for the firm’s operations.

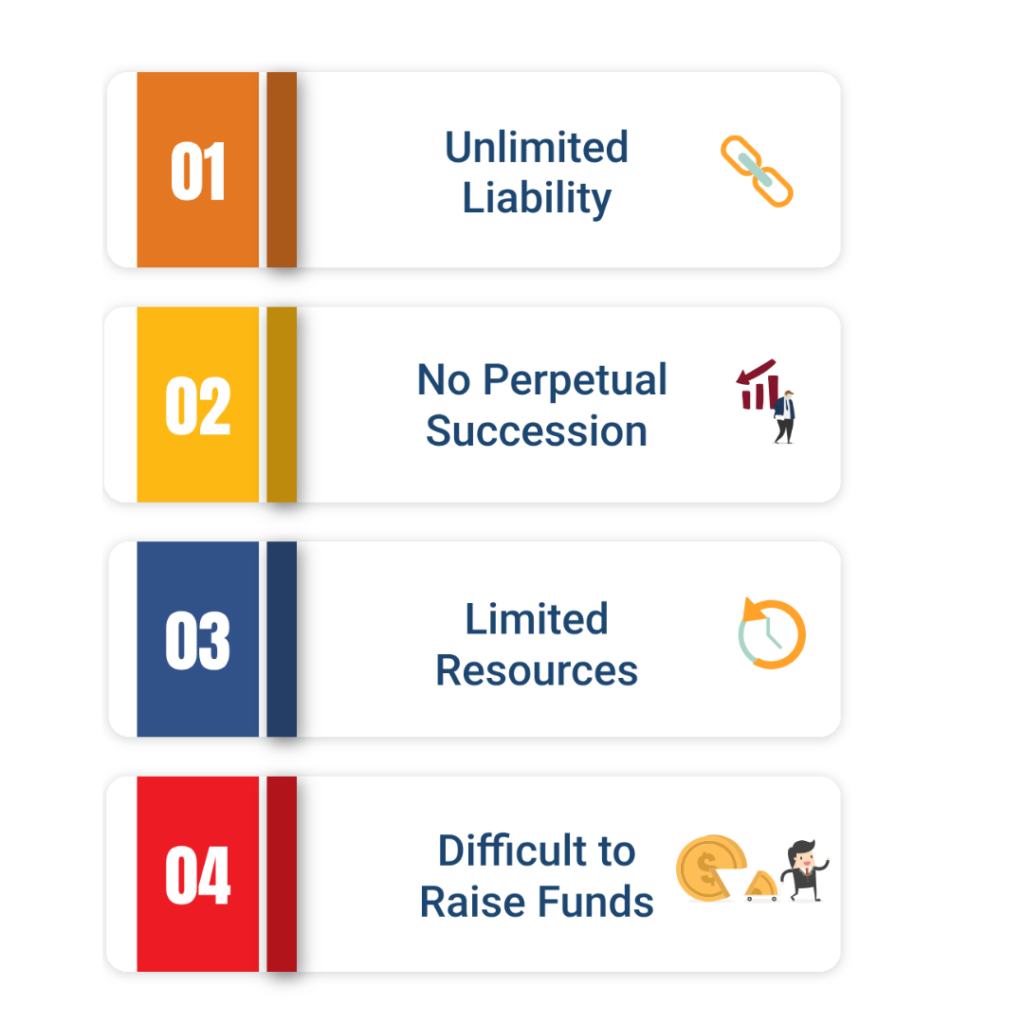

Disadvantages of Partnership Firm Registration

The following are some disadvantages of Partnership Firm Registration:

1: Unlimited Liability: The major disadvantage of a partnership firm is that the partners’ liability is unlimited. The partners must cover the firm’s loss out of their personal estate. In contrast, the liability of shareholders or partners in a business or LLP is limited to the number of their shares. The liability caused by one of the partnership firm’s partners must be borne by all of the firm’s partners. If the firm’s assets are insufficient to satisfy the obligation, the partners must repay the creditors with their personal property

2: No Perpetual Succession: A partnership firm, unlike a corporation or an LLP, does not have perpetual succession. This means that the death of a partner or the insolvency of all but one of the partners will bring an end to a partnership firm. It can also be dissolved if one of the partners provides the other partners notice of the firm’s dissolution. As a result, the partnership firm can dissolve at any time

3: Limited Resources: A partnership firm can have a maximum of 20 participants. The number of partners is limited, and so the capital invested in the firm is similarly limited. The firm’s capital is the total of the amounts invested by each partner. This limits the firm’s resources, and the partnership firm cannot pursue large-scale projects

4: Difficult to Raise Funds: Raising capital is challenging since the partnership firm lacks perpetual succession and a separate legal entity. In comparison to a company or an LLP, the firm has fewer possibilities for generating capital and expanding its operations. People have less trust in the firm because there are no strong legal requirements. The firm’s financial statements do not have to be made public. As a result, borrowing money from outside people is difficult